Financing Women through Partnership with an Incubator in Ard El-Khair (Egypt)

Overview

Egypt was a fast-growing economy that slowed to 4.7% growth in 2009 due to the global economic crisis. Egypt’s exports were severely hit affecting critical sectors such as Agriculture, mining and cotton. Inflation rates were high at more than 10% partly due to the government’s policy of reducing energy subsidies.

Unemployment among youth is the most important challenge facing Egypt with 650,000 new entrants into the labor force every year. Over 25% of youth between the ages 20-29 are unemployed. The Arab Spring revolution which was driven by the youth in 2011 further worsened the economic situation. Key sectors such as tourism as well as other related sectors suffered from the instability that followed.

Many of the youth have difficulty in getting a job, and starting a new business is just as challenging, with difficulties in registering property, taxes and other regulatory issues. Micro and Small Enterprises (MSEs) account for approximately 85% of non-agricultural private sector employment. However, despite its importance in generating employment, only one percent of bank credit goes to MSEs according to the Central Bank of Egypt. In addition, most of the credit provided are done on conventional terms which are not suitable for 90% of the population which professes to be Muslim.

Challenge

According to the National Impact Survey of Microfinance in Egypt and a market assessment by the International Finance Corporation (IFC) in 2009, 2.1 to 3 million MSEs do not have any access to finance. Only an estimated 250,000 have access to some financial services. Hence, about 85% of enterprises need access to financial services.

For the first time, IsDB provided Restricted Mudaraba financing under a special program dedicated to creating employment for youth. The Youth Employment Support (YES) program provided USD 50 million to Egypt through the Social Fund for Development (later renamed as Micro Small and Medium Enterprise Development Agency or MSMEDA). The program provided Unemployed Potentially Active Youth(UPAY), particularly heads of households (men and women) opportunities to be more self-sufficient by establishing income generating activities.

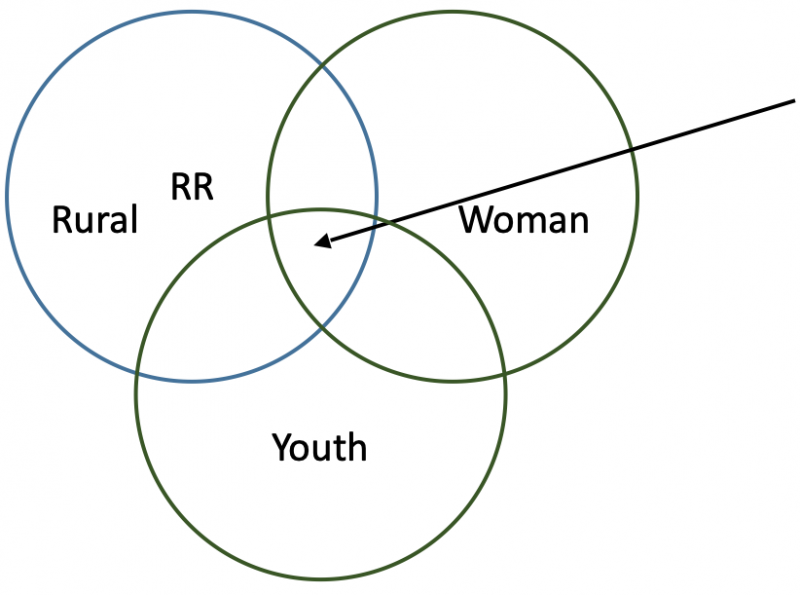

For young women, this disadvantage is intensified by the difficulties faced by all new labor market entrants, including delayed school-to-work transition and low-quality jobs (Assaad 2008). In other words, female youth face challenges in finding decent work both as women and as young people.

A survey conducted by UN Women showed that the level of economic activity among female youth in Egypt is strikingly low relative to their male peers. 82.1% of nonstudent female youth are out of the labor force, compared to only 13.6% of nonstudent male youth. This means that 6.5 million female youth are neither in school nor working, a significant underuse of Egypt’s human capital resources. The survey also found that the average duration of unemployment among youth in Egypt is 120 weeks, or more than two years. Among young males the average is 109 weeks while the average for young females is significantly longer at 141 weeks.

Although the YES program was focused on Youth Employment, the challenge was to ensure that the most vulnerable segments of the population were not left out. The Ard El Khair which was financed by the YES program in Egypt aimed to address that challenge.

Solution

Ard El Khair adopted an innovative financing contractual structure linking MSMEDA, Ard El Khair and the young women partners. The objective was to provide the young women an adequate income in a low risk environment while providing them with the required expertise in cattle fattening.

At the end of the incubation period, the young women would also receive a certification for the expertise they have gained on cattle fattening while earning some income in the process. Ard El Khair would benefit from low cost loans provided by the YES program that are used to purchase cattle for the women to fatten under the incubation program. The company would also receive a share of the profits in exchange for selling the cattle and providing training to the young women.

The first step to this project was to sign a Memorandum of Understanding between Ard El Khair and MSMEDA and agree on the areas of cooperation pertaining specifically to the process of sourcing and engagement with the young women partners. There had been four rounds of financing so far with an average of 150 poor youths incubated (90% of whom were women). These youths were selected from an average of 2000 applicants for each round. The selection process is done jointly between Ard El Khair and MSMEDA. Under this arrangement, MSMEDA.

Focus is on the legal and financial arrangements and needs while Ard El Khair engages the young women on providing technical expertise in cattle fattening:

- Sourcing of the ruminants in bulk to ensure a low price.

- Providig the technical know-how on fattening the cattle to the client.

- Arranging for the sale of the end beneficiary’s fattened cattle to the market.

- Entering into a partnership agreement with the end beneficiary.

- Facilitating in the process of getting a loan for the beneficiary by acting as the guarantor while the end beneficiary would commit to the incubation program and work in the farm for 12 hours per week during the incubation period of 9 months.