What we do

The Inception and History of the IsDB Economic Empowerment Approach

Since early 2000, IsDB has been improving its Microfinance interventions to alleviate poverty. Filed evidences show that limiting the interventions to either financing or capacity-building only was neither an effective nor a sustainable approach in achieving the desired result. Therefore, IsDB has recently launched a tailored innovative solution called Economic Empowerment (EE) which enables targeted beneficiaries to play an active role in the economies of their countries and let them aspire for a decent living.”

Despite the success of the previous IsDB interventions, mainstreaming the approach of the EE in all the Member Countries required a holistic vision and genuine support. The IsDB management foresaw the potential of the EE approach and chose to adopt the methodology to achieve the Bank’s vision on empowering the poor in its member countries.

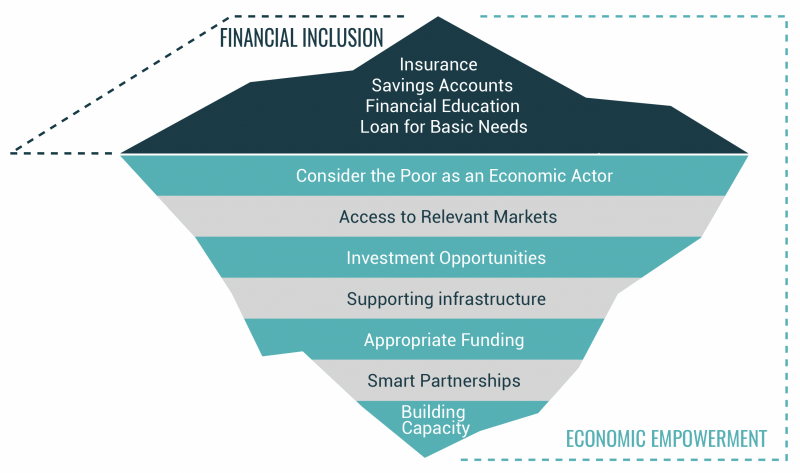

The Theory of Change in the Economic Empowerment: from the Financial Inclusion to the Economic Inclusion

Economic Empowerment approach considers poverty alleviation process as more complex and dynamic in nature, and not only related to access to financial services. One definition of poverty alleviation is to address poverty in all its social, economic and cultural dimensions simultaneously: income level, housing, access to financial services, health, education and social justice.

In fact, facts indicate that microloans are more beneficial to borrowers living above the poverty line than to borrowers living below the poverty line. Clients with more income are willing to take the risks, such as investing in new technologies that will most likely increase income flows. Poor borrowers, on the other hand, tend to take out conservative loans that protect their subsistence. The vast majority of poor clients are caught in subsistence activities. The poor obtaining a microloan may be trapped in debt if they are unable to fully leverage the loan to grow its business. Thus, microfinance falls short of its true objective and may cause more harm than good.

Poverty alleviation is indeed about addressing a much broader set of needs. Amartya Sen, the Nobel Prize-winning economist, eloquently argues that development can be seen as a “process of expanding the real freedoms that people enjoy.” In Economic Empowerment approach, these freedoms can be achieved by focusing on the productivity and the economic sustainability of the activities of the vulnerable groups. Therefore, in this approach, poverty alleviation starts with Economic Inclusion. The objective of economic inclusion is to establish a genuine relationship between the recipient of the financing and the economy. The economic inclusion of a person involves a process linking him/her to the real economy by discovering investment opportunities adapted to his/her skills and needs, opening up communication channels with economic players, setting up a technical and managerial capacity building plans, and, of course, funding. Value chain financing plays an important role in developing financial products suited for economic inclusion.

The process of economic inclusion is an innovative approach to reach and finance vulnerable populations. The process is triggered with the identification of the economic and strategic partner (Value Chain Leader) and obtain a firm commitment from its side to absorb the production of the beneficiaries of the financing over a specific period of time. Then, the financial institution should develop and engineer its own development project and expand its scope of services to business development for the benefit of the poor. Once all the variables and components of the project are sealed in a realistic business model, capacity-building modules are developed and beneficiaries are contacted and selected to be part of the project. Ultimately, funding is dispensed and a partnership is concluded between the marginalized populations and the strategic and commercial partner. Finally, assistance and project follow-up is conducted during the lifetime of the contractual agreement.

The fruits of these developments’ efforts are nonetheless limited to the quality of the infrastructure where the poor populations live. In fact, achieving higher income will undoubtedly make it easier to access health, education, clean water and quality housing. However, executing development projects without taking into consideration the complications related to infrastructure is certainly a flawed approach. Hence, a pillar in developing Economic Empowerment projects is to build solid and sustainable partnerships with the public sector, private sector and civil society. The result is to develop effective synergies between all the partners to build a solid ecosystem with a direct impact on healthcare, education, housing, water and sanitation services. This collaboration will eventually lead to a more balanced and broader intervention for a better life quality.

In conclusion, the IsDB Economic Empowerment approach addresses the following six obstacles to unlock the full potential of the poor:

- Difficult access to well designed & profitable Project Opportunities;

- Lack of Intelligent Partnerships, supporting the poor’s economic activity;

- Insufficient affordable & appropriate Supporting Infrastructure;

- Lack of access to an Appropriate Funding;

- Lack of Capacity & weak belief in Self-Potential;

- Difficult access to relevant Markets;

The Economic Empowerment methodology represents a paradigm shift from financial inclusion to economic inclusion since it aims to provide economic opportunities to the poor through providing financial and non-financial solutions that aim to help them in their journey towards a better life. It provides the poor with appropriate access to the required inputs/means to not only achieve his/her financial inclusion but to enable him/her to contribute to the economy.

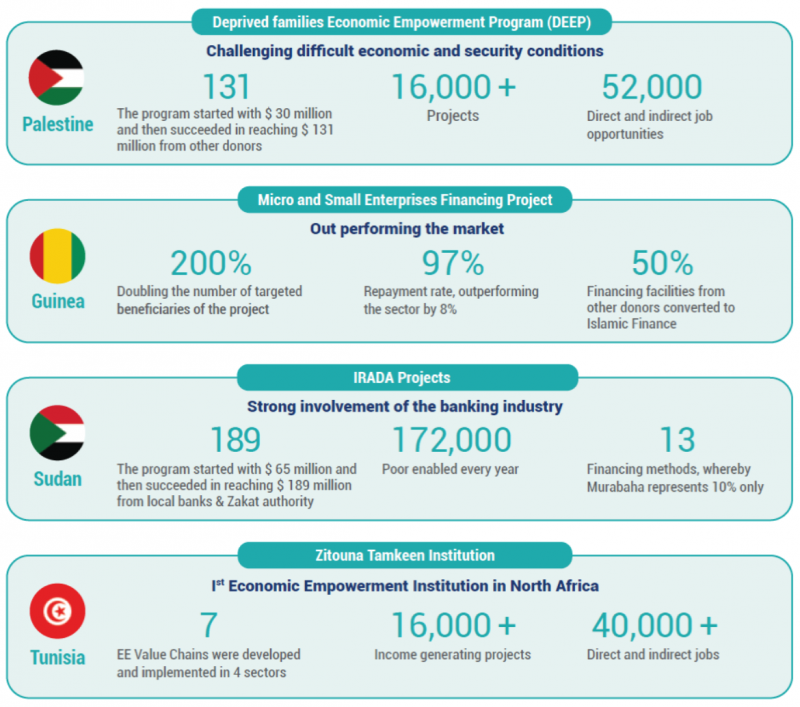

The Economic Empowerment Approach in Action: Track records of Successful Interventions & Efficient Business Models

The IsDB Economic Empowerment methodology was developed based on 20 years of IsDB experience supporting the poor through Islamic microfinance. The first Islamic microfinance project of the IsDB was in 2001 for Guinea amounting to US$ 1.45 million. Since then, 56 projects amounting to US$ 548 million have been approved. These interventions include the Microfinance Support Program financed by ISFD and equity investments under the Microfinance Development Program.

Impactful Microfinance Institutions supported by IsDB have been successful in conducting group-oriented value-chain Islamic microfinance. They have also been able to negotiate for better suppliers and buyers in the value chain on behalf of their clients. By developing partner financial institutions’ capacity to engage in trade and investment with farmers through actual involvement in the value-chain (instead of being an arm’s length lender), IsDB has helped initiate the implementation of the Economic Empowerment Approach. Such institutions have become more competitive and this has helped them have a better prospect of ensuring sustainability while delivering value to their client.

IsDB has observed several successful microfinance or the financial institutions are able to go beyond the role of the financial intermediary and provide ‘Smart’ financing that value adds and helps the poor to come out of poverty. Below are some examples of the impact generated through Economic Empowerment interventions.

The business models practiced by these microfinance or financial institutions put the Economic Empowerment (EE) approach in action. First, Linking Beneficiaries to Markets, where EE goal is to expand the scope of the markets available to the poor- from village markets to provincial markets or to national markets similar to what happened in Sudan. Second, Venture Capital Investment through diminishing Musharaka, is an example how a financial institution can start a company and train youth to take over the company over a period of time such as what happen in Wad Balal cattle fattening project in Sudan. Third, financial institutions can also engage in a Partnership with a Lead Firm, to help the poor to develop their capacity to supply to the lead firm which commits to purchase their supply, advises on the quality standards required and supports the capacity building of the poor’s microenterprises, such as the Dairy partnership with Danone in Tunisia. Finally, financial institutions can work with non-governmental organizations to finance beneficiaries that participate in an incubator. Under this partnership, Ard El Khair in Egypt developed cattle fattening incubator where young women in rural areas can be trained and supported with financing to fatten cattle for a period of 9 months.

The Economic Empowerment and the COVID-19’s response

The Bank developed the Strengthening the Economic Resilience of Vulnerable Enterprises (SERVE) program in collaboration with ISFD to support R2 (Restore track) of the IsDB SPRP with the objective of building the resilience of affected MSMEs to overcome the pandemic crisis by providing the needed liquidity for business continuity and job preservation.

SERVE Program

Strengthening the Economic Resilience of Vulnerable Enterprises (SERVE) Program was designed to provide immediate and targeted cash-flow support to businesses that are adversely impacted by COVID-19 as well as to sustain their business operations beyond the crisis. The main goal of this program is to design a Restore Support Package targeting the MSMEs in IsDB’s priority MCs. The Program was designed based on global benchmarks and best practices in order to support the Governments’ efforts in curbing the Covid-19 impact on their economies. It will contribute to sustaining current and future working capital requirements, funding innovation and adaptation of the MSME’s business operations to mitigate the impact of COVID-19.

The program is expected to create or maintain 314,000 jobs from financing more than 150,000 MSMEs through a US$ 240 Million package. Furthermore, SERVE Program will integrate in collaboration with, the leading provider of Blockchain and Fintech solutions in the MENA Region, a Blockchain solution that will allow the IsDBG as well as the financial institutions partners under the SERVE Program to monitor and report on a live basis the utilization of the lines of finance by the MSMEs benefiting from the Program.

ISFD Guarantee Facility

The ISFD Guarantee Facility has an innovative structure that will be able to unlock more than US$ 100 Million in financing for the MSMEs. It entails providing conditional concessional loans to MCs, covered by a Sovereign Guarantee and triggered only when the loss is incurred and compensated by the Guarantee Facility. ISFD and partners will also jointly contribute to the seed capital of the fund. This structure will combine the insurance services offered by the Guarantee Facility with the financial and non-financial services provided by SERVE Program to the MFIs, creating full synergy and a strong tool to help the FIs support MSMEs.

Conclusion

As shown in the table below Economic Empowerment approach aims to overcome shortcomings that are associated with the conventional micro-credit. Finally, IsDB Economic Empowerment approach is about engineering the relevant business opportunities, then providing the necessary financial and non-financial services to help the poor in their journey towards a better life. To do this, there needs to be a paradigm shift in the microfinance sector. For better impact and sustainability, there should be a stronger focus to go beyond the promotion of financial services so as to ensure the economic inclusion of their clients into the mainstream economy.

|

Shortcomings in the Conventional Microfinance |

How IsDB Economic Empowerment has addressed them |

|

Only focuses on Access to finance |

Provides support to access to financial and non-financial support |

|

Risk adverse. Mitigates through collaterals and guarantees |

Risk mitigating approach through knowledge and capacity building |

|

Arm’s length financing |

Value chain financing |

|

General loan terms and conditions |

Customized financing approach |

|

Is not attached to assets- leads to diversion of funds |

Is backed by assets. Prevents diversion of funds |

|

Focuses on client’s ability to repay |

Focuses on client business ability to share its profits as repayment |

|

Client is a debtor |

Client is a business partner |